Are you prepared to take your investment sport to the following degree? Look no further than the Nifty Option Chain, a powerful device that could assist force your success in the stock marketplace. In this weblog publish, we can discover how know-how and leveraging the Nifty Option Chain can unleash your investment capacity and pave the manner for options trading.

Understanding the Basics of Options Chain Trading

Before we dive into the Nifty Option Chain, let’s short recap the fundamentals of alternative chain trading. Options are monetary derivatives that supply buyers the proper, but not the obligation, to buy or promote an asset (in this case, stocks) at a predetermined price within a special time frame.

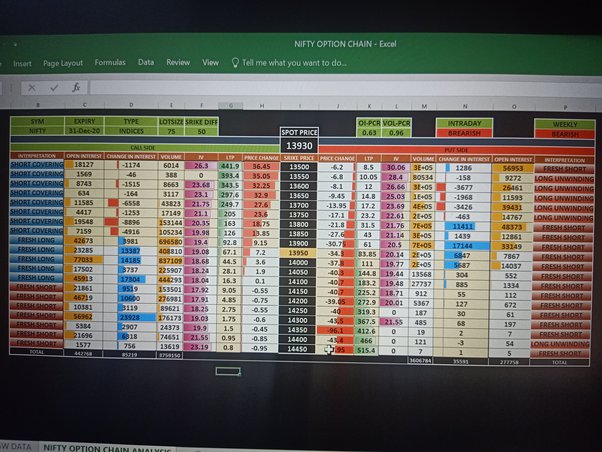

The Nifty Option Chain, particularly the Nifty 50 index in India, is a complete information set that presents all of the available names and put options for the Nifty index. It gives essential facts which include the spot price, call options, put alternatives, open interest, and implied volatility.

Unleashing the Power of Nifty Option Chain Trading

One of the important thing advantages of analyzing the Nifty Option Chain is gaining insights into marketplace sentiment. By reading calls and positioning alternative statistics, you could become aware of developments, patterns, and potential shifts in marketplace sentiment. Keep a watch out for vast increases or decreases in open interest, as this could imply the involvement of institutional players and their effect on marketplace actions.

Determining key guide and resistance ranges

The Nifty Option Chain may be a valuable device for identifying key assist and resistance degrees. Support represents the rate degree at which a stock or index has a tendency to stop falling, whilst resistance indicates the extent to which it struggles to exceed. By studying the choice chain information, you may identify clusters of open interest at unique strike fees, which regularly correspond to important help and resistance ranges. Additionally, thinking about implied volatility can provide a comprehensive evaluation of capacity reversal factors.